Cost of living correspondent

Getty Images

Getty ImagesThe Bank of England is expected to keep interest rates on hold when its policymakers announce their next decision later.

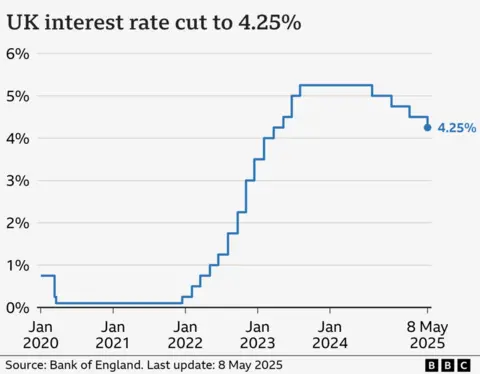

The Bank cut the rate to 4.25% in early May, when its Monetary Policy Committee (MPC) also hinted at more reductions to come.

But analysts think those cuts will not arrive until later in the year, as the rate of price rises remains above target.

The Bank rate is the key benchmark for lenders setting the cost of borrowing, and for banks and building societies deciding what returns to pay to savers.

The decision will be announced by the MPC at 12:00 BST.

When interest rates were cut in May from 4.5% to 4.25%, it was the fourth reduction in a year.

While the downward staircase of interest rates is expected to continue, there are some complicated and conflicting issues for the nine-member committee to consider.

Growth in the UK economy remains somewhat sluggish, putting pressure on policymakers to cut rates to boost investment and growth.

The economy unexpectedly shrank by 0.3% in April after taxes increased for businesses, household bills jumped, and exports to the US plunged.

However, the rate of inflation remained at its highest level for more than a year in May, at 3.4%.

Food prices, in particular, jumped. As an essential for any household budget, that creates a further squeeze on personal finances.

The Bank uses interest rates as its primary tool for bringing inflation to its target level of 2%. A rise in rates can limit demand and therefore reduce inflation, although that has an impact on the economy.

Policymakers will also be closely monitoring the impact of global tensions. The conflict between Israel and Iran could well push up the price of oil.

As well as affecting the price paid by drivers at the pumps, any sustained increase would have a significant effect on inflation.

Meanwhile, the fall-out from the US policy on tariffs will also need to be factored into their calculations.

Many economists believe there will be two more interest rate cuts by the Bank this year. However, some others only expect one.

“We forecast inflation to remain above 3% for the remainder of the year amidst persistent wage growth and the inflationary effects from higher government spending,” said Monica George Michail, associate economist at the National Institute of Economic and Social Research.

“Additionally, the current tensions in the Middle East are causing greater economic uncertainty. We therefore expect the Bank of England to keep rates on hold this Thursday and implement just one further cut this year.”

How it affects you

Expectations for the Bank’s base rate are influential in what High Street banks and lenders charge customers to borrow money or what they give to savers.

The higher level in recent years has meant people are paying more to borrow money for things like mortgages and other loans, but savers have also received better returns.

More than eight in 10 customers have fixed-rate deals, and have been seeing increased bills when renewing in recent years.

Fixed mortgage rates have been relatively static in recent weeks. The latest figures show the average rate on a two-year fixed mortgage was 5.12% while, for a five-year deal, it was 5.10%, according to financial information service Moneyfacts.

About 600,000 homeowners have a mortgage that tracks the Bank’s rate, so any rate cut would have an immediate impact on monthly repayments.